Ethiopia’s Debt Deemed Unsustainable as IMF–World Bank Sound Alarm

BaseLine Team

19 Sep, 2025

Ethiopia’s debt has been declared unsustainable by the World Bank and International Monetary Fund, with the joint Debt Sustainability Analysis (DSA) warning that repayment risks remain high despite recent restructuring progress.

The assessment, approved by senior officials from both institutions, cited “protracted breaches of exports-related external debt” as the main factor, compounded by a weakened international support base following the Tigray conflict and Ethiopia’s December 2024 default on its $1 billion Eurobond.

Ethiopia has been under the G20 Common Framework for Debt Treatment since 2021. The Official Creditor Committee suspended debt service for 2023–2024 and in March this year reached an agreement in principle with Ethiopian authorities on restructuring terms. A memorandum of understanding is expected soon, paving the way to restore a “moderate risk of debt distress” by FY2027/28, when the IMF program ends.

Here are the key points from the IMF–World Bank Joint Debt Sustainability Analysis (DSA) on Ethiopia.

𝟏. 𝐃𝐞𝐛𝐭 𝐒𝐢𝐭𝐮𝐚𝐭𝐢𝐨𝐧

Ethiopia is in Debt Distress

Total public and publicly guaranteed (PPG) debt: 34.8% of GDP as of June 2024 (down from 48.9% in 2021/22).

External debt share: 44.5% of total PPG debt, mainly owed to multilateral lenders like the World Bank.

Debt distress: Ethiopia missed a Eurobond interest payment in December 2023 and is officially classified as being in debt distress.

𝟐. 𝐃𝐞𝐛𝐭 𝐑𝐞𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐢𝐧𝐠 𝐔𝐧𝐝𝐞𝐫𝐰𝐚𝐲

G20 Common Framework: Official Creditor Committee (OCC) suspended debt service for 2023–2024.

Agreement in principle: Reached March 2025 with OCC on restructuring terms.

Goal: Bring debt indicators below risk thresholds and achieve a “moderate risk of debt distress” rating by the end of IMF program in FY2027/28.

𝟑. 𝐌𝐚𝐜𝐫𝐨𝐞𝐜𝐨𝐧𝐨𝐦𝐢𝐜 𝐎𝐮𝐭𝐥𝐨𝐨𝐤

Growth: GDP grew 8.1% in 2023/24; projected 7.2% for 2024/25 and 7.5–8% over the medium term.

Drivers: Agriculture (good rainfall, irrigation expansion) and mining (especially gold), plus electricity generation.

Risks: Political instability, security issues, reform fatigue, and social discontent from subsidy cuts.

𝟒. 𝐅𝐢𝐬𝐜𝐚𝐥 𝐏𝐨𝐥𝐢𝐜𝐲 & 𝐃𝐨𝐦𝐞𝐬𝐭𝐢𝐜 𝐃𝐞𝐛𝐭

Domestic debt: 19.3% of GDP; government relies heavily on Treasury bills and direct advances from the central bank.

T-bill yields: Now at 16.4% (from 1–2% previously).

Reforms: Phasing out financial repression (mandatory bank bond purchases), moving toward market-based financing, and recapitalizing CBE to clean up SOE debt.

𝟓. 𝐄𝐱𝐭𝐞𝐫𝐧𝐚𝐥 𝐒𝐞𝐜𝐭𝐨𝐫 & 𝐅𝐗 𝐌𝐚𝐫𝐤𝐞𝐭

Exports: Coffee and gold exports surged, helping narrow current account deficit to –3.2% of GDP.

FX reforms: Market-determined exchange rate introduced, reducing parallel market premium (still ~15%).

Reserves: Gross international reserves at $4B as of April 2025, above earlier projections.

𝟔. 𝐈𝐧𝐟𝐥𝐚𝐭𝐢𝐨𝐧 & 𝐌𝐨𝐧𝐞𝐭𝐚𝐫𝐲 𝐏𝐨𝐥𝐢𝐜𝐲

Inflation: Fell to 13.6% in March 2025 (from 15%), helped by agricultural output and policy tightening.

Target: Single-digit inflation by 2028, assuming continued fiscal discipline and market reforms.

𝟕. 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐧𝐠 𝐆𝐚𝐩 & 𝐃𝐨𝐧𝐨𝐫 𝐒𝐮𝐩𝐩𝐨𝐫𝐭

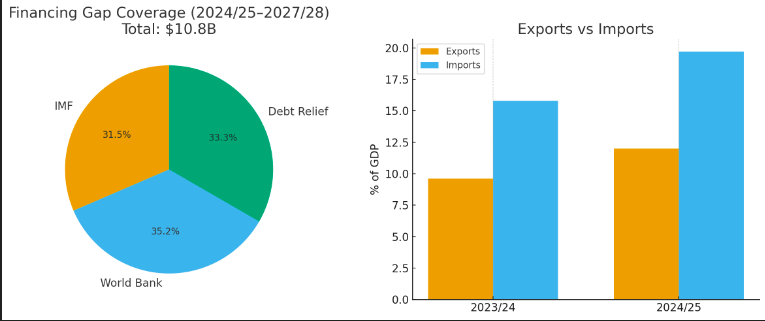

Financing needs: $10.8B over program period (2024/25–2027/28).

Expected support: $3.4B IMF, $3.8B World Bank budget support, $3.6B debt relief.

Privatization: Assumes no near-term proceeds, as investor appetite remains weak.

𝟖. 𝐑𝐢𝐬𝐤𝐬 & 𝐕𝐮𝐥𝐧𝐞𝐫𝐚𝐛𝐢𝐥𝐢𝐭𝐢𝐞𝐬

Key vulnerabilities: Export shocks, currency depreciation, delays in debt restructuring, cutbacks in aid, and domestic security deterioration.

Upside potential: Sustained gold and coffee exports, improved security, and stronger investor confidence could accelerate recovery.